Our Offerings

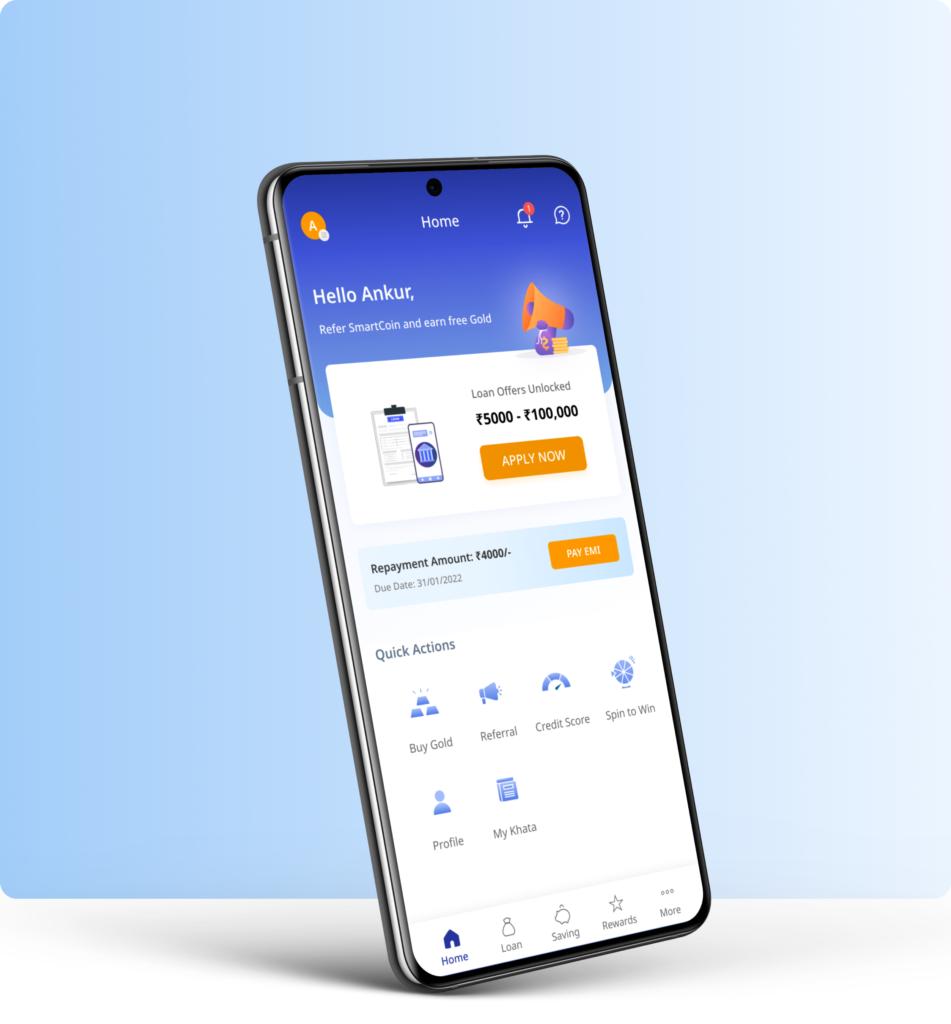

Instant Personal Loans

Get loans using 100% digital and safe process from your mobile within minutes of application.

Gold Rewards

Earn rewards in gold by making timely loan repayments, referring friends and more.

Gold Savings

Save regularly with as low as ₹10 on 24K, 99.9% pure digital gold to grow your savings.

Reach and Scale

Pan-India Presence

1.11+ cr

Trusted Users

1,700+ cr

Loan Amount Disbursed

Hear it from happy customers across India

SmartCoin in the news

SmartCoin raises Rs 80 crore in debt funding

Fintech platform SmartCoin Financials has raised Rs 80 crore in debt funding from multiple financial institut ..

4 FinTechs empowering MSMEs for financial inclusion and growth

The MSME sector ( Micro, Small, and Medium enterprises) plays a vital role in the growth and contribution of the developing ..

How SmartCoin is disbursing loans and credit services utilizing AI and machine learning

Even before the pandemic, the demand for small business loans through official channels have been on an increase, and this ..

Bringing you the best of lessons, stories and trends in Fintech

Why NBFCs are a better option for instant loans as compared to banks?

26 Sep 2022

Instant Personal loans are a great product that caters to the ever-increasing demand for liquidity and funds among individuals without foraying into the space of specialized loans such as auto or home loans, which come with specific guidelines on fund utilization

The benefits of instant personal loans and why it’s getting popular day by day?

23 Aug 2022

Personal loans are widely available, require no collateral, and have low-interest rates. Furthermore, they are simple and quick to set up. You are free to use your loan money however you see fit.

Maintaining your CIBIL score after taking out an instant loan

29 Aug 2022

The most well-known of the four credit information organizations licensed by the Reserve Bank of India is the Credit Information Bureau India Limited (CIBIL).